Senate Targets Trump and Musk in Explosive New Crypto Ban Bill

Featured Image Credit: U.S. Department of Agriculture

In a dramatic turn of events on Capitol Hill, U.S. lawmakers have unveiled a pair of explosive new legislative proposals targeting the intersection of politics and cryptocurrency. The End Crypto Corruption Act and the Modern Emoluments and Malfeasance Enforcement (MEME) Act have been introduced by Senate and House Democrats, respectively, with the express aim of curbing the ability of high-ranking government officials to engage in or profit from digital asset ventures. These proposals appear to take direct aim at prominent figures like former President Donald Trump and tech billionaire Elon Musk, who have recently made headlines with their involvement in the crypto space.

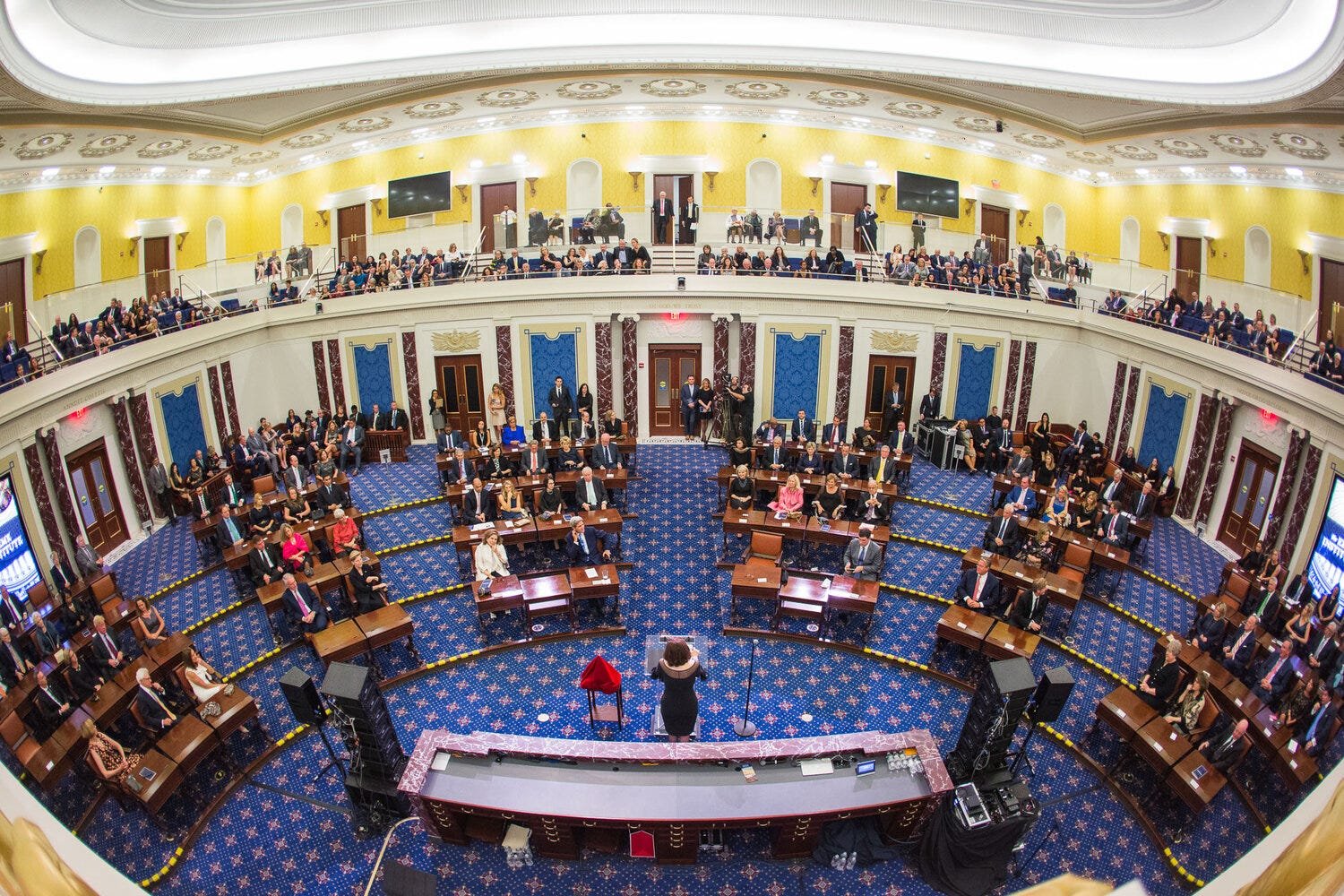

Featured Image Credit: White House

The End Crypto Corruption Act, introduced in the Senate, would bar the president, vice president, members of Congress, and their immediate family members from investing in or promoting cryptocurrencies. This sweeping restriction comes in the wake of revelations that the Trump family could stand to gain over $2 billion from a stablecoin deal negotiated with a Dubai-based firm. Adding fuel to the fire, Trump recently launched a meme coin contest offering bizarre prizes such as private dinners and guided tours of the White House in exchange for coin ownership, raising eyebrows about the ethical and legal implications of such a promotion.

Parallel to the Senate proposal, House Democrats have brought forth the MEME Act. This bill would make it a criminal offense for current and former high-ranking government officials to launch, promote, or profit from any cryptocurrency or related project. Notably, the legislation is retroactive, meaning it could penalize actions already taken by Trump and other public figures. Melania Trump, for instance, was involved in the launch of a meme coin earlier this year, which quickly skyrocketed to a multi-billion-dollar valuation, further exacerbating concerns about political profiteering.

The introduction of these bills represents a clear response to what lawmakers view as a growing ethical crisis at the nexus of public office and private enrichment through unregulated digital finance. “Public service should be about serving the public, not lining your pockets through shady crypto schemes,” said Senator Mark Kelly, a co-sponsor of the End Crypto Corruption Act. “We cannot allow government officials to exploit their positions for personal gain in the volatile and often opaque world of cryptocurrency.”

Political reactions to the proposed legislation have been intense and polarizing. Trump allies have come out swinging against the bills, accusing their sponsors of political persecution. Roger Stone, a longtime Trump confidant, took things a step further, making a dangerous and incendiary remark by calling for the execution of Senator Kelly for his role in introducing the anti-crypto legislation. The comment was widely condemned across party lines and served to underscore the rising political tensions surrounding the crypto debate.

Beyond the personal drama, the bills have already begun to influence the legislative landscape surrounding digital assets more broadly. The bipartisan stablecoin legislation known as the GENIUS Act, which had been making steady progress, is now facing headwinds. Democrats have begun to withdraw their support, citing conflicts of interest involving the Trump family and a lack of sufficient safeguards to prevent money laundering and address national security concerns. What once looked like a promising effort to bring regulatory clarity to the stablecoin market is now mired in controversy, potentially delaying crucial reforms to the digital finance ecosystem.

Elon Musk, while not directly named in the bills, has also found himself under scrutiny. Musk has long been a vocal proponent of various cryptocurrencies, including Dogecoin and Bitcoin, and his tweets have historically had outsized effects on digital asset markets. Lawmakers have expressed concern that influential figures like Musk wield too much power in an unregulated financial landscape, and some have hinted that future amendments could specifically address the ability of tech moguls to manipulate markets via social media.

Critics of the proposed legislation argue that it constitutes government overreach and infringes on the financial freedoms of public servants. “If a member of Congress can invest in the stock market, why not in crypto?” said a Republican lawmaker who requested anonymity. “This is about targeting political enemies under the guise of ethics.”

However, supporters counter that the unique characteristics of digital assets—such as their anonymity, ease of cross-border transfer, and high volatility—make them particularly ripe for abuse. They argue that stricter rules are necessary to ensure transparency and to prevent potential conflicts of interest, especially when national security is at stake.

The bills also have implications for how cryptocurrencies are perceived by the broader public. With high-profile figures like Trump and Musk dominating headlines, there’s a risk that digital assets could become increasingly politicized, undermining their credibility and adoption. Financial analysts warn that associating crypto too closely with political personalities could lead to regulatory whiplash and market instability.

International observers are also watching the developments with keen interest. The U.S. has long been a trendsetter in financial regulation, and these bills could influence how other countries choose to manage the intersection of politics and crypto. In the European Union and Asia, similar discussions are underway, with regulators debating how to maintain ethical standards while fostering innovation.

As of now, the End Crypto Corruption Act and the MEME Act remain in committee, but their impact is already being felt. They have sparked a national conversation about the ethical responsibilities of public figures in the age of decentralized finance and have highlighted the need for updated regulatory frameworks that reflect the realities of the 21st-century digital economy.

Whether or not the bills pass, they signal a growing appetite in Washington to rein in the Wild West nature of the crypto world—especially when it intersects with the highest echelons of political power. And as public scrutiny intensifies, figures like Trump and Musk may find that their influence in the crypto arena comes at a higher political cost than anticipated.

In a rapidly evolving financial landscape, the U.S. government’s latest legislative efforts may mark a turning point—one where ethics, law, and digital innovation collide in unprecedented ways.